Privacy Policy

JMAC Lending, Inc. together with its affiliates and operating as JMAC, JMAC Home Loans and SOL Mortgage (together, “JMAC Lending”, “us” or “we”) values your trust and is dedicated to protecting your privacy. JMAC Lending provides the following privacy policy (the “Privacy Policy”) in order to describe how we collect, use, or disclose personal information we receive through our website and any related online and offline services provided in connection with our services (as used herein, the “Services”). This policy also describes your choices about the collection and use of your information.

Please read the Privacy Policy carefully before you start to use our Services. By using any of the Services, you agree to be bound and abide by our posted Terms of Use (“Terms”) and this Privacy Policy. Please read our Terms of Use regarding your legal rights in any dispute involving our Services.

Please keep in mind that if you have a financial product or service with us, your information that we maintain in connection with that financial product or service will be subject to our Consumer Privacy Notice. The Consumer Privacy Notice addresses our privacy obligations to you under the Gramm-Leach-Bliley Act (“GLBA”) and the Fair Credit Reporting Act (“FCRA”), and it will supersede this Privacy Policy in the event of any conflict.

We may update this Privacy Policy from time to time. When we do, we will let you know by appropriate means such as by posting the revised policy on this page with a new “effective date” date at the bottom of this Privacy Policy. Any changes to this Privacy Policy will become effective when posted unless indicated otherwise.

By using the Services, you represent and warrant that you are of legal age to form a binding contract with Company and meet all of the eligibility requirements in these terms. The Services are intended only for individuals who are at least 13 years old and we do not knowingly collect personal information from children under 13 without parental consent.

1. how we collect Information

We collect personally identifiable information about you when you voluntarily provide such information, through your use of our Services, or from third parties we may partner with.

2. TYPES OF INFORMATION WE COLLECT

In order to better provide you with our Services, we may collect the following categories of information:

Contact information, such as your name, mailing address, e-mail address, phone number, interest in different services we may offer, and preferences such as when to receive our communications;

Financial and transactional information, such as in connection with the financial services we provide to you—this may include social security number, assets, income, property information, other credit relationships, and other information we receive from applications or other forms you complete, or from reports we receive from credit bureaus, appraisers, employers and other relevant third parties;

Survey information in response to questions we may send you through the Services, such as for research or feedback purposes;

Communications between you and us, such as via e-mail, mail, phone or other channels;

Online User Activity described in the next section.

Job applicants may also provide us information as part of an employment application that includes such information such as the applicant’s name, email, education and employment history, resume, and cover letter. We do not use this information for any purpose other than to evaluate the individual for employment with us. Job applicants may provide additional information for routine background checks to a third-party provider of such services, under specific privacy terms and consents that will be provided at the time of collection.

3. ONLINE USER ACTIVITY, COOKIES AND INFORMATION COLLECTED BY OTHER AUTOMATED MEANS

Cookies are a commonly-used web technology that allow websites to store and retrieve certain information on a user’s system, and track users’ online activities. We and our service providers may collect information about your use of our Services by such automated means, including but not limited to cookies, pixels and other similar technologies.

Cookies and similar technologies can help us automatically identify you when you return to our website or app. Cookies help us review website traffic patterns and improve the website, determine what Services are popular. We can also use such information to deliver customized content and advertising to users of the Services whose behavior indicates that they are interested in a particular subject area.

When you use the Services, the information we may collect by automated means includes, for example:

Usage Details about your interaction with our Services (such as the date, time, and length of visits, and specific pages or content accessed during the visits, search terms, frequency of the visits, referring website addresses);

Device Information including the IP address and other details of a device that you use to connect with our Services (such as country, network type, device type and model, operating system information, browser type and screen size)

Location information if you choose to share information about your device’s location with our website.

If a user does not want information collected through the use of cookies, most browsers allow the visitor to reject cookies, but if you choose to decline cookies, you may not be able to fully experience the interactive features our Services provide.

4. HOW WE USE YOUR INFORMATION

We may use the information we obtain about you for purposes allowed by applicable laws as provided in this Privacy Policy and our Consumer Privacy Notice, including:

Provide our Services to you, including to establish and maintain any account you create for our Services, including to process loans and payments in connection with our financial services;

Respond to your requests, questions and comments and provide customer support;

To personalize the content we may display to you in our Services and communications;

Operate, evaluate and improve our programs, our websites and other products and services we offer (including to develop new services), and to diagnose or fix technology problems;

Inform you about changes to this Privacy Policy and our Terms of Use and other applicable policies;

Comply with and enforce as needed applicable legal and regulatory requirements, industry standards, our policies and our contractual rights;

Monitor the performance of our Services including metrics such as total number of visitors, traffic, and demographic patterns; and

Where permitted by law, for marketing or promotional activities.

We may also use or share information in an anonymized or aggregate manner for many purposes such as research, analysis, modeling, marketing, and advertising, as well as improvement of our Services.

5. HOW WE PROTECT YOUR INFORMATION

We endeavor to maintain reasonable administrative, technical and physical safeguards designed to protect the personal information we maintain against accidental, unlawful or unauthorized destruction, loss, alteration, access, disclosure or use. We limit access to customer information to only those authorized individuals who need such information to perform their job functions in connection with the Services. We train our employees on how to protect customer information and maintain policies that prohibit the unauthorized disclosure or use of that information. However, we cannot ensure the security of any information you transmit to us, or guarantee that this information will not be accessed, disclosed, altered, or destroyed. We will make any legally required disclosures in the event of any compromise of personal information. To the extent the law allows us to provide such notification via e-mail or conspicuous posting on the Services, you agree to accept notice in that form

6. PERMITTED DISCLOSURES

We will not disclose your personal information to third parties without your consent, except in the following circumstances.

We may share your information with third parties as necessary to facilitate your transactions (e.g., loans and payments) with us, consistent with applicable financial services laws.

We may share your information as permitted by law, including, for example, with our affiliates and service providers that we believe need the information to perform a technology, business, or other professional function for us (examples include IT services, maintenance and hosting of our Services, payment processors, marketing partners, and other vendors). We only provide such vendors with information so they can perform their required functions on our behalf. We may use vendors to collect information from you through our Services (e.g., website).

We also may disclose information about you (i) if we are required to do so by law, regulation or legal process, (ii) when we believe disclosure is necessary to prevent harm or financial loss, (iii) in connection with an investigation of suspected or actual fraudulent or illegal activity; or (iv) under exigent circumstances to protect the personal safety of our staff, users or the public.

We reserve the right to transfer the information we maintain in the event we sell or transfer all or a portion of our organization or assets. If we engage in such a sale or transfer, we will make reasonable efforts to direct the recipient to use your personal information in a manner that is consistent with this Privacy Policy.

Unless prohibited by applicable law or other contractual terms governing your use of the Services, we may, from time to time, contact you on behalf of external partners about a particular offering that may be of interest to you. In those cases, your information (e.g., e-mail, name, address, telephone number) is not transferred to the third party. We may instead, for example, share anonymous data with trusted partners to help perform statistical analysis, and then we would send you an email or postal mail on their behalf.

Any disclosure we make will be in accordance with our Consumer Privacy Notice, as applicable, and as permitted by law.

7. YOUR PRIVACY CHOICES

We offer you certain choices about what information we collect from you, how we use and disclose the information, and how we communicate with you.

Accessing and Correcting Your Information: Keeping your account information up-to-date is very important. You may review or update certain account information and transactions by logging in to one or more portal made available to you in connection with the Services, or by contacting us as directed below.

Marketing Mail & Emails: From time to time, where permitted by our Consumer Privacy Notice and applicable law, we may contact you via mail & email for the purpose of providing promotional offers, communications regarding your account or transactions, surveys, or other general communications. In order to improve our Services, we may be notified when you open an email from us or click on a link therein. You may choose not to receive marketing emails from us by clicking on the unsubscribe link in the marketing emails you receive from us. Even if you opt out of receiving such communications, we will continue sending you non-marketing email communications, such as messages regarding our Services to you or administrative notices.

Text messages: In the event you are enrolled in any service we provide that includes text messages to you, you can opt-out by replying “STOP” to any text message received.

Cookies: Web browsers may offer users the ability to disable receiving certain types of cookies; however, if cookies are disabled, some features or functionality of our websites may not function correctly.

User Account: Where permitted by the terms of the financial services you receive from us, you may be able to terminate your account by contacting us as provided below. We may retain any account information for internal purposes, as required by applicable laws, and as otherwise provided in our Consumer Privacy Notice, this Privacy Policy and our Terms of Use.

8. STATE-SPECIFIC NOTICES

For California residents, the California Consumer Protection Act (the “CCPA”) provides various rights to individuals and households with respect to the collection and use of personal information that we have collected about you. Among other rights under the CCPA, you have the right to request that we: (i) disclose to you any personal information that we have about you; (ii) delete personal information that we have about you (subject to certain exceptions); or (iii) not “sell” your information to a third party (excluding qualified service providers), as that term is interpreted under the CCPA. If you are a California resident, you can submit such requests to us via the contact information provided below and we will complete the request within the timeframe permitted by law.

It is unlawful for us to discriminate against an individual for exercising any rights provided by the CCPA. We do not provide a financial incentive or a price or service difference to customers in exchange for the use, disclosure, or sale of their information, or to deter individuals from making such requests. We may send promotions or offers to individuals enrolled in our marketing communications.

However, please note that any personal information we collect from or about individuals in connection with our financial products or services are treated in accordance with applicable federal and state privacy laws such as the Gramm-Leach-Bliley Act (“GLBA”), Fair Credit Reporting Act (“FCRA”) and California Financial Information Privacy Act (“FIPA”). We therefore use and share any such information consistent with our Consumer Privacy Notice, referenced above, and such information is not generally within the scope of the CCPA.

Because there is not yet a consensus on how companies should respond to web browser-based do-not-track (“DNT”) mechanisms, we do not respond to web browser-based DNT signals at this time, but we do not collect information about users’ online activities across third-party websites.

For Nevada residents, please note that we do not sell personal information as defined by Nevada law (Ch. 603A, Sec. 1.6). You can submit a request to us regarding the sale of such information via the contact information provided below.

9. LINKS TO OTHER SITES, INCLUDING CUSTOMER PORTALS

Users may find advertising or other content on our website that links to third party sites. Those third-party sites may have their own privacy policies or no policy at all. Our Privacy Policy does not apply to such other sites. JMAC Lending has no control over the content displayed on such sites, nor over the measures, if any, that are taken by such sites to protect the privacy of your information.

In particular, certain customer portal links provided on our website are provided on third party sites. To the extent we receive information about your activity on those portals (such as your financial transactions), that information is retained by us consistent with this Privacy Policy and our Consumer Privacy Notice, as applicable. However, your activity on those portals may also be subject to the privacy policy of the third party providing such portal, and we encourage you to read the privacy statements of any other website that collects your personal information.

10. INTERNATIONAL CONSIDERATIONS

Our Services are controlled and operated by us from the United States and are not intended to subject us to the laws or jurisdiction of any state, country or territory other than those of the United States.

11. CONTACTING US

If you have any questions, concerns or comments about this Privacy Policy, our privacy practices, or if you would like us to update information or preferences you provided to us, please contact JMAC Lending’s Customer Support by phone at 949-390-2688 or by or email to info@jmaclending.com.

CALIFORNIA PRIVACY NOTICE

This CCPA PRIVACY NOTICE is for California residents only and supplements the information contained in the Privacy Statement of JMAC Lending, Inc., and its DBAs; JMAC Home Loans and Sol Mortgage (collectively, “we,” “us,” or “our”) and applies solely to visitors, client’s, users, and others who reside in the State of California (“consumers” or “you”). We adopt this notice to comply with the California Consumer Privacy Act of 2018 (“CCPA”) and other California privacy laws. Any terms defined in the CCPA have the same meaning when used in this notice.

Under CCPA, California residents have the right to know about information collected disclosed or sold, the right to opt out of the sale of certain information, and a limited right to have businesses delete information a business has collected about the consumer. These rights extend only to California residents and information covered by CCPA. Because CCPA does not cover all consumer data in all situations, only certain consumer data is subject to these rights.

Other laws may govern data we gather about you, or you provide to us including, but not limited to:

· Information to or from a consumer reporting agency if that information is to be reported in, or used to generate, a consumer report as defined by subdivision (d) of Section 1681a of Title 15 of the United States Code, and use of that information is limited by the federal Fair Credit Reporting Act (15 U.S.C. Sec. 1681 et seq.)

· Information collected, processed, sold, or disclosed pursuant to the federal Gramm–Leach–Bliley Act (Public Law 106–102), and implementing regulations, or the California Financial Information Privacy Act (Division 1.4 (commencing with Section 4050) of the Financial Code). PLEASE NOTE: Any personal data collected in relation to a mortgage loan is exempt from the consumer rights to know, delete and opt-out created under CCPA because this information is governed by the Gramm-Leach-Bliley Act, the Fair Credit Reporting Act, the California Financial Information Privacy Act or other state and federal laws which exempt this data from CCPA.

Information We Collect

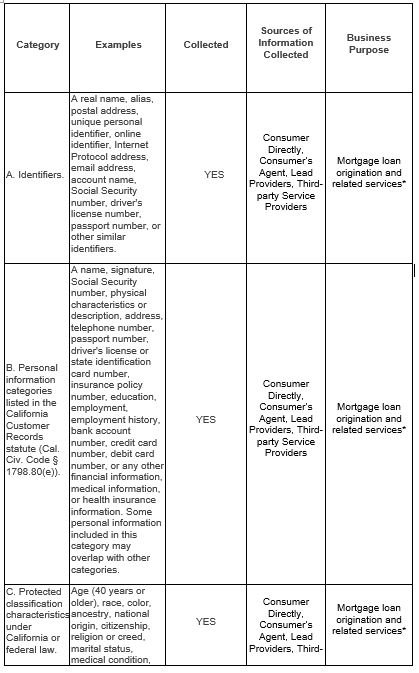

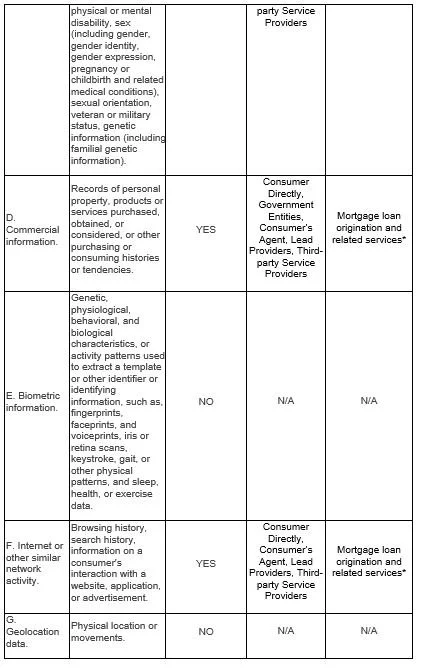

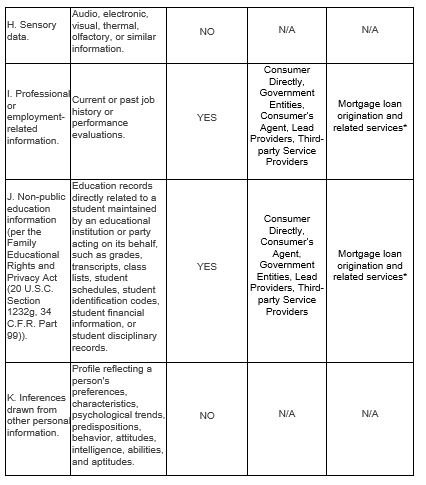

JMAC Lending, Inc. (“Company” or “we”) collects information that identifies, relates to, describes, references, is capable of being associated with, or could reasonably be linked, directly or indirectly, with a particular consumer or device (“Personal Information”). As described above, not all of the Personal Information collected below is subject to CCPA. All Personal Information collected pursuant to this notice that is subject to CCPA is collected for a Business Purpose and may be shared with service providers if necessary to perform a Business Purpose. We may have collected the following categories of personal information from consumers within the last 12 months:

* Related services may include, but are not limited to real estate services, loan underwriting, insurance, escrow and other closing services, notary, appraisal, other consumer credit services, home warranty, and other services related to home purchase, home ownership, or related consumer transactions.

Rights under CCPA

The CCPA provides consumers (California residents) with specific rights regarding their personal information. This section describes your CCPA rights and explains how to exercise those rights.

Right to Know About Personal Information Collected, Disclosed, or Sold. California consumers have the right to request that a business disclose what personal information it collects, uses, discloses, and sells over the past 12 months.

Right to Request Deletion of Personal Information. Under CCPA, you may have the right to request the deletion of your personal information collected or maintained by the Company subject to certain exceptions.

Right to Opt-Out of the Sale of Personal Information. Under CCPA, you may have the right to opt-out of the sale of their personal information by a business. Note that as defined in CCPA, the Company does not, and will not, sell your personal information.

Right to Non-Discrimination for the Exercise of a Consumer’s Privacy Rights. Under CCPA, you have the right not to receive discriminatory treatment by the Company for the exercise of the privacy rights conferred by the CCPA.

Instructions for Exercising Rights to Know, Opt-Out, and Deletion Rights

To submit a verifiable consumer request to exercise the above-mentioned rights, you must either email us at: info@jmaclending.com or call us at: 949-390-2688.

After submitting a request, we will verify your identity by matching the identifying information provided by you to the personal information already maintained by us, or, in cases where your request requires a higher degree of certainty, we may use a third-party identity verification service or ask for a photo ID or for more information. Any information you provide us that is not already in our system will be deleted after your request has been fulfilled.

The verifiable consumer request must:

· Provide sufficient information that allows us to reasonably verify you are the person about whom we collected personal information or an authorized representative.

· Describe your request with sufficient detail that allows us to properly understand, evaluate, and respond to it.

We cannot respond to your request or provide you with personal information if we cannot verify your identity or authority to make the request and confirm the personal information relates to you. Making a verifiable consumer request does not require you to create an account with us. We will only use personal information provided in a verifiable consumer request to verify the requestor's identity or authority to make the request. Our practices with regard to verifying a request will vary depending on the request and the information we have on the person making the request.

Authorized Agents

Only you or a person registered with the California Secretary of State that you authorize to act on your behalf, may make a verifiable consumer request related to your personal information. You may also make a verifiable consumer request on behalf of your minor child.

If you use an authorized agent to submit a request to know or a request to delete, you must provide the Company with written permission from you giving the authorized agent permission to submit the request on your behalf, and you may be required to verify the authorized agent’s identity with the Company. The Company may deny a request from an agent that does not submit proof that they have been authorized by the consumer to act on their behalf.

Changes to Our Privacy Notice

We reserve the right to amend this privacy notice at our discretion and at any time. When we make changes to this privacy notice, we will notify you by email or through a notice on our website homepage.

Additional Information

If you have any questions or comments about this notice, our Privacy Statement, the ways in which we collect and use your personal information, your choices and rights regarding such use, or wish to exercise your rights under California law, please do not hesitate to contact us at: info@jmaclending.com or 949-390-2688.